Returns Of A Century

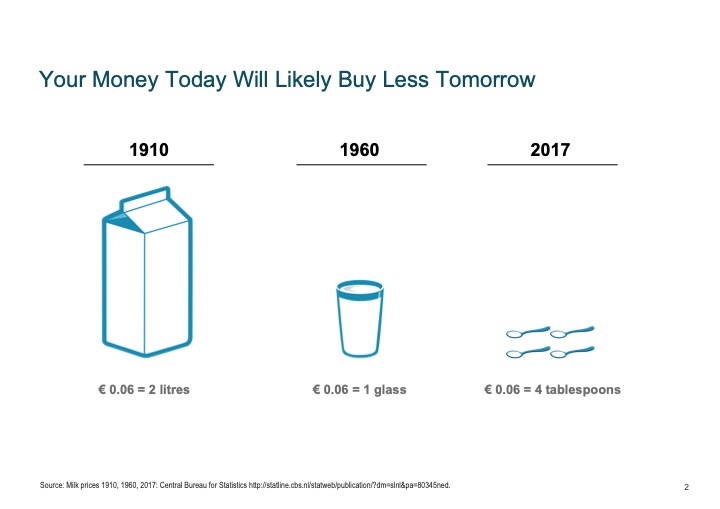

The following is a good example why people invest:

On one hand: You anyway bear a risk beyond your willingness to knowledge (eg. inflation)

On the other hand: Long term investment is appropriate for wealth building.

Figure 5 comes from the publication” Triumph of the Optimists” by Elroy Dimpson, Paul Marsh és Mike Staunton. The authors used the same figure in their work of Credit Swiss Global Investment Returns Yearbook 2018 Summary Edition, and it is taken from there with their permission.

"Figure 5 shows annualized real equity, bond, and bill returns over the last 118 years for the 21 Yearbook countries with continuous investment histories plus the world index, the world ex-USA, and Europe, ranked in ascending order of equity market perfor-mance. The real equity return was positive in every location, typically at a level of 3% to 6% per year.

Equities were the best-performing asset class everywhere. Furthermore, bonds beat bills in every country except Portugal. This overall pattern, of equities beating bonds and bonds beating bills, is precisely what we would expect over the long haul, since equities are riskier than bonds, while bonds are riskier than cash."

It is visible that the European return shows a very similar value to that of the world excluding the US, slightly above 4 %.The world average is 5,2 %, US is on No.3 position with 6,5 %.The winner is South Africa closely followed by Australia.

As we speak about real returns it is obvious that investment into equities is the most effective way of wealth building on the long run.

For those interested in further insight I recommend downloading the whole publication from the internet as it is freely available in English.

All in all it is worth remembering that it is a must to invest to build wealth but it does really matter into what and how you do it.

As you can see on the following chart you do not need to have hundred plus years to achieve dramatically different investment results in various asset classes.The following chart shows hypothetical growth of one GBP over a 25 year period. .

And one more argument:

Therefore, I would propose diving into correlation of risk and return here. I promise it is worth doing it.